TAMPA, Fla. — Eutelsat is a step closer to the financing needed to refresh its OneWeb low Earth orbit (LEO) broadband constellation, after the French operator’s board approved plans Nov. 18 to raise nearly $1 billion from anchor shareholders.

The company said it expects to settle the reserved capital increase in the coming days following commitments from the French and British governments, Indian conglomerate Bharti, shipping giant CMA CGM and the FSP investment fund backed by seven France-based insurers.

The 828 million euro ($959 million) capital raise was priced at 4 euros per share, a 32% premium to their average price over the 30 days before it was announced June 19.

France is leading the investment and is set to nearly double its stake in Eutelsat to 29.65%. Bharti, the U.K., CMA CGM and FSP would hold 17.88%, 10.89%, 7.46% and 4.99%, respectively.

Eutelsat said the anchor shareholders have also committed to fully participate in a separate 634 million euro rights issue planned before the end of the year, representing more than 70% of the shares on offer.

Alongside plans to sell passive ground segment infrastructure, the operator said the extra capital will enable it to take out loans on more favorable terms to invest in OneWeb and contribute to IRIS², Europe’s proposed sovereign broadband constellation.

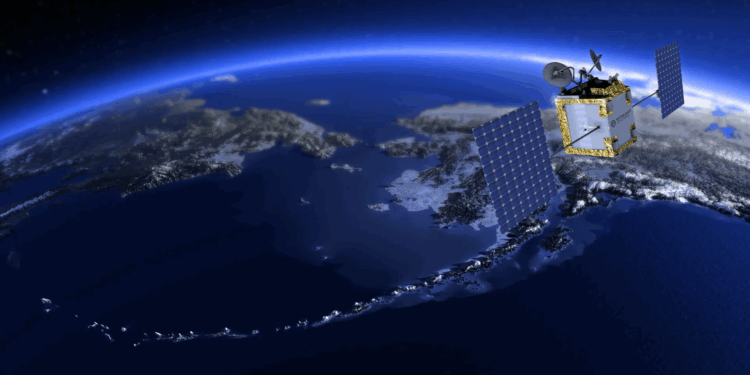

Most of the more than 650 OneWeb satellites in LEO were launched between 2020 and 2023, giving the constellation an expected design life running through 2027-2028.

Eutelsat has plans to invest up to 2.2 billion euros for the 440 LEO satellites needed to sustain OneWeb over the coming years, with the first 100 ordered from Europe’s Airbus slated to begin launching in late 2026.

The company has also committed about 2 billion euros for its share of the IRIS² public-private partnership, which envisions services around the end of the decade.

During Eutelsat’s latest earnings results Oct. 21, the company said it continues to expect operational revenue for the year to June 30 to be broadly in line with the 1.23 billion euros recorded in the previous fiscal year, with a 50% increase in its LEO business helping offset declines in geostationary services.